Mortgage Rate Trends from the 1970s to 2020

Downtown San Diego Condo for Sale

February 14, 2020Ocean Beach family discovers scammers put house up for rent

March 5, 2020Mortgage Rate Trends from the 1970s to 2020

Read the full Value Penguin article here:

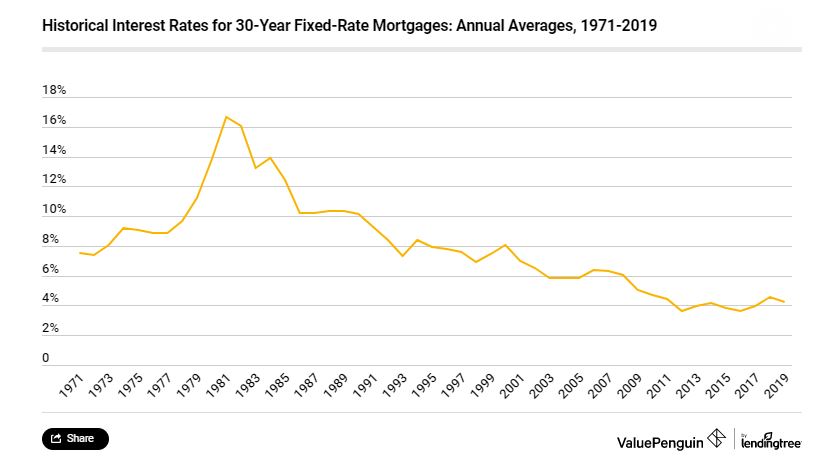

Since 1971, historical mortgage rates for 30-year fixed loans have hit historic highs and lows due to various factors. Using data from Freddie Mac’s Primary Mortgage Market Survey (PMMS), we’ll do a deep dive into what’s driven historical mortgage rate movements over time, and how they affect buying or refinancing a home.

In 1971, the same year when Freddie Mac started surveying lenders, 30-year fixed-rate mortgages hovered between 7.29% to 7.73%. The annual average rate of inflation began rising in 1974 and continued through 1981 to a rate of 9.5%. As a result, lenders increased rates to keep up with unchecked inflation, leading to mortgage rate volatility for borrowers.

The Federal Reserve combated inflation by increasing the federal funds rate, an overnight benchmark rate that banks charge each other. Continued hikes in the fed funds rate pushed 30-year fixed mortgage rates to an all-time high of 18.63% in 1981. Eventually, the Fed’s strategy paid off, and inflation fell back to normal historical levels by October 1982. Home mortgage rates remained in the single-digits for much of the next two decades.

The mortgage rates trend continued to decline until rates dropped to 3.31% in November 2012 — the lowest level in the history of mortgage rates. To put it into perspective, the monthly payment for a $100,000 loan at the historical peak rate of 18.63% in 1981 was $1,558.58, compared to $438.51 at the historical low rate of 3.31% in 2012.

This year, interest rates are expected to stay around 3.8%, according to Freddie Mac. This is good news for consumers as home prices continue to rise.