2023 California Housing Market Outlook

For Sale in Santee

October 21, 2022

California Real Estate Market Minute Write-Up

March 8, 20232023 California Housing Market Outlook

Housing Perspective: 2023 Housing Market Outlook by the California Association of Realtors

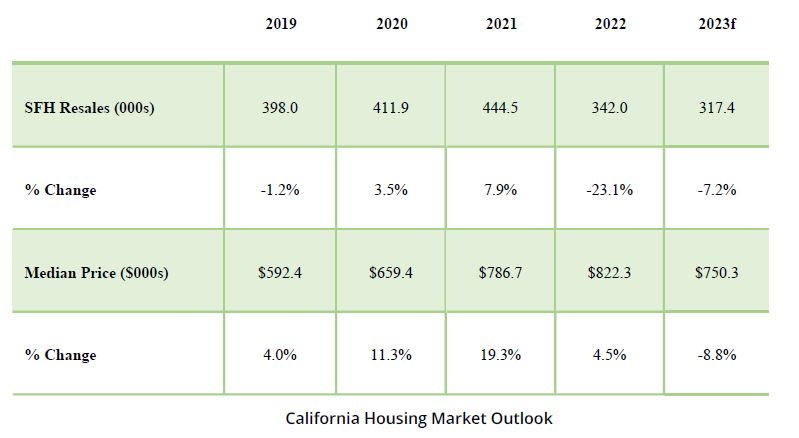

Over the past year, the housing market in California has shifted dramatically and rapidly. At the end of 2020, existing single family home sales totaled more than 500,000 units on an annualized basis—the highest level of transactions in California in over a decade. In 2021, the momentum continued as home sales averaged nearly 450,000 units for the year—a 12-year record as well. By the end of 2022, home sales had retreated by nearly 50% to less than 250,000 units on an annualized basis.

Demand for homes has been impacted by rapidly rising mortgage rates that have eroded purchasing power and caused some would-be homebuyers to press pause on their search. Although rates are still relatively low by historic standards, the housing market has rarely had to adjust as quickly—prior to 2022, Freddie Mac has never reported mortgage rates doubling over the span of less than 1 year. This has a tremendous impact on homebuyers: at current median prices, each 100bps increase in mortgage rates equates to an additional $400/month in interest cost on the same home.

At the same time, housing supply also remains very depressed. In January, the number of homes that were listed for sale on multiple listing services fell by more than 30% from even the depressed levels of 2022. Based on data from Freddie Mac, nearly 85% of homeowners have mortgages at or below 4% and nearly all of them have mortgages at less than 5%, which has created a lock-in effect for many homeowners that are now discouraged from moving by rising borrowing costs. As a result, the forecast for home sales in 2023 is expected to show further slowing from last year’s pace. California home sales are expected to fall roughly 7% this year, while the statewide median price is projected to decline for the first time since the financial crisis.

As for the economy, inflation will cool off throughout the year, but the pace of decline is expected to be slow. The Fed Reserve will continue to hike rates in the first half of 2023 to keep prices from flaring up again, which could lead to further economic slowdown in the second half of the year. Many consumers have already expressed concerns about their financial wellbeing and planned on cutting back in the next 12 months, while recent survey results suggest that businesses also plan on curbing their expenses in the upcoming year. With retail sales, investment spending, and job growth all projected to fall in the next few quarters, the economy could slip into a mild recession starting in the third quarter of 2023.