September 27, 2022

Published by Linda at September 27, 2022

Categories

If you’re ready to buy the home of your dreams, but rising rates have kept you on the fence, there may be an option – a temporary rate buydown. What’s a temporary rate buydown? With a cost paid by the seller or builder, your loan’s interest rate is ‘bought down’, meaning reduced, for an initial temporary period. There are no surprises; the rate buydown is adjusted each year by a […]

February 27, 2020

Published by Jennifer Rohr at February 27, 2020

Categories

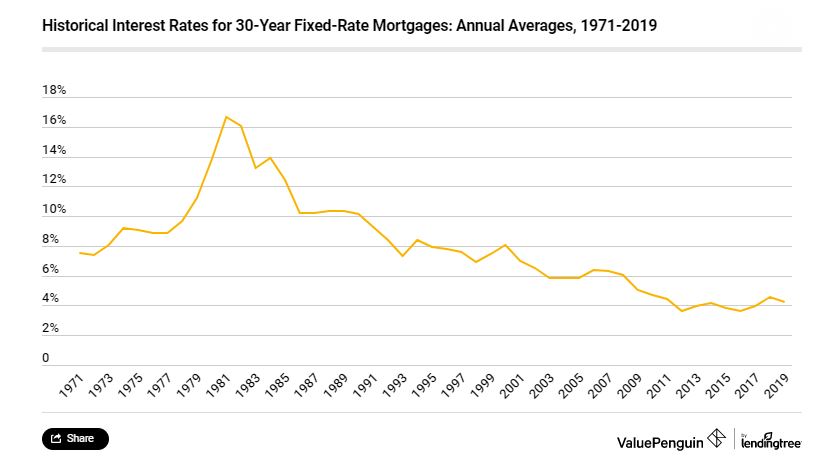

Read the full Value Penguin article here: Since 1971, historical mortgage rates for 30-year fixed loans have hit historic highs and lows due to various factors. Using data from Freddie Mac’s Primary Mortgage Market Survey (PMMS), we’ll do a deep dive into what’s driven historical mortgage rate movements over time, and how they affect buying or refinancing a home. In 1971, the same year when Freddie Mac started surveying lenders, […]

April 8, 2019

Published by Jennifer Rohr at April 8, 2019

Categories

Homebuyers won big last week as the industry saw the lowest mortgage rates since January 2018. Recent numbers from Freddie Mac reported the average rate on a 30-year fixed mortgage fell to 4.06% percent with an average 0.5 point for the week ending March 28, 2019. Why are mortgage rates taking a nose dive? Freddie Mac’s Chief Economist, Sam Khater, explains that this low point is a crucial indicator that […]